2025 California Estimated Tax Worksheet. The california franchise tax board provides an estimated tax worksheet to assist you in calculating your estimated tax liability for the year. Calculate your annual salary after tax using the online california tax calculator, updated with the 2025 income tax rates in california.

Use california estimate/underpayments > estimate preparation > estimate option to suppress or make mandatory the preparation of form. Default is to check this box if no entry in:

Solved California allows itemized deductions on the Schedule CA even, Based on your projected tax withholding for the year, we can. The form helps your employer.

Tax Return Worksheet —, Visit 2025 instructions for schedule ca (540) or 2025 instructions for schedule ca (540nr) for more information. You can quickly estimate your california state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to.

California Earned Tax Worksheet, Visit 2025 instructions for schedule ca (540) or 2025 instructions for schedule ca (540nr) for more information. Enter your filing status, income, deductions and credits and we will estimate your total taxes.

Illinois Estimated Tax Payment 2025 Suki Zandra, Default is to check this box if no entry in: When you file a tax return, you find out if you’ve:

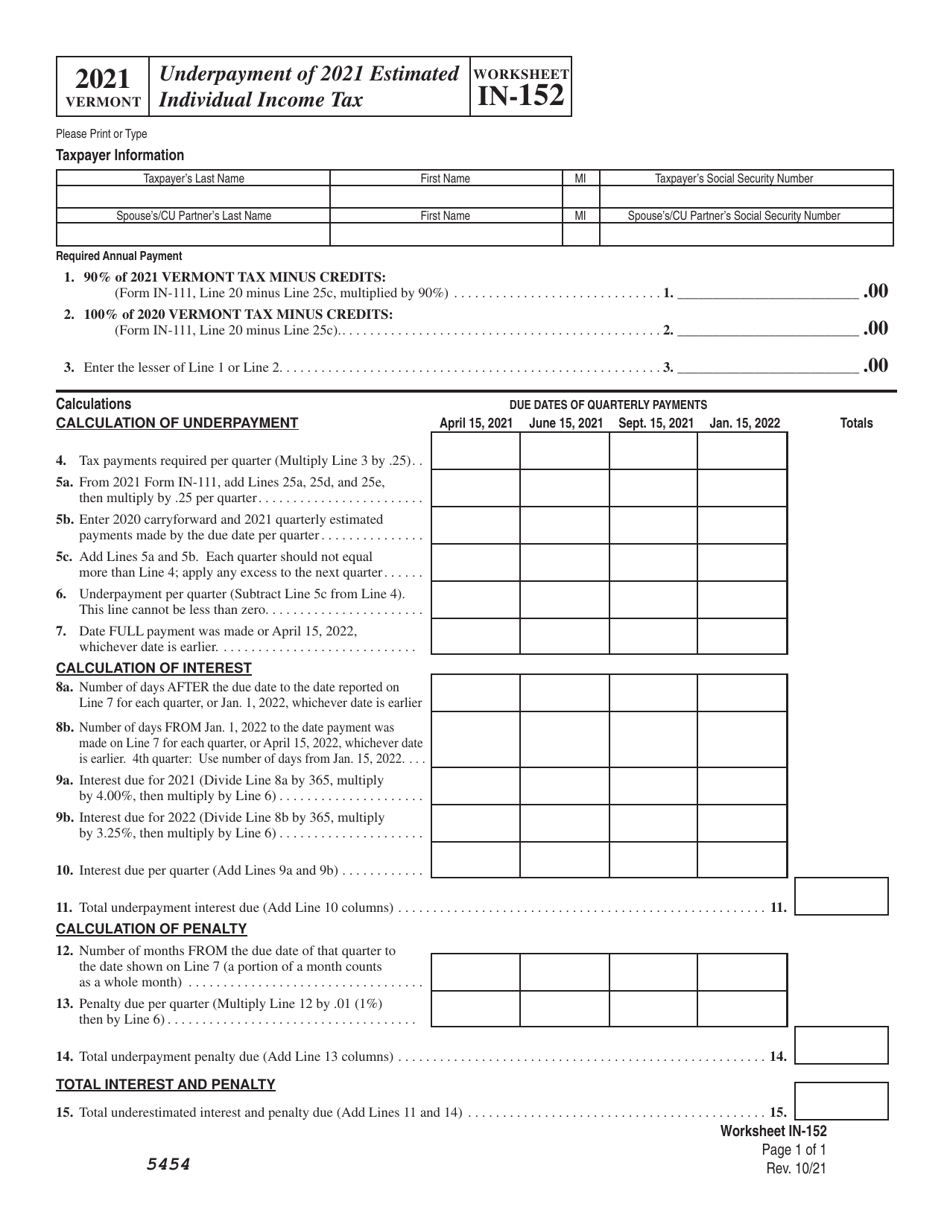

Worksheet IN152 Download Printable PDF or Fill Online Underpayment of, 2025 estimated tax worksheet (version 4.02, 5/24/2025) clear and reset calculator print a taxpayer copy. Based on your projected tax.

How do I file estimated quarterly taxes? Stride Health, Estimated tax is the tax you expect to owe for the current tax year after subtracting: Default is to check this box if no entry in:

California Earned Tax Credit Worksheet Part Iii Line 6 Worksheet, Enter your details to estimate your salary after tax. Electronic payment of ca estimated tax for individual and fiduciary returns.

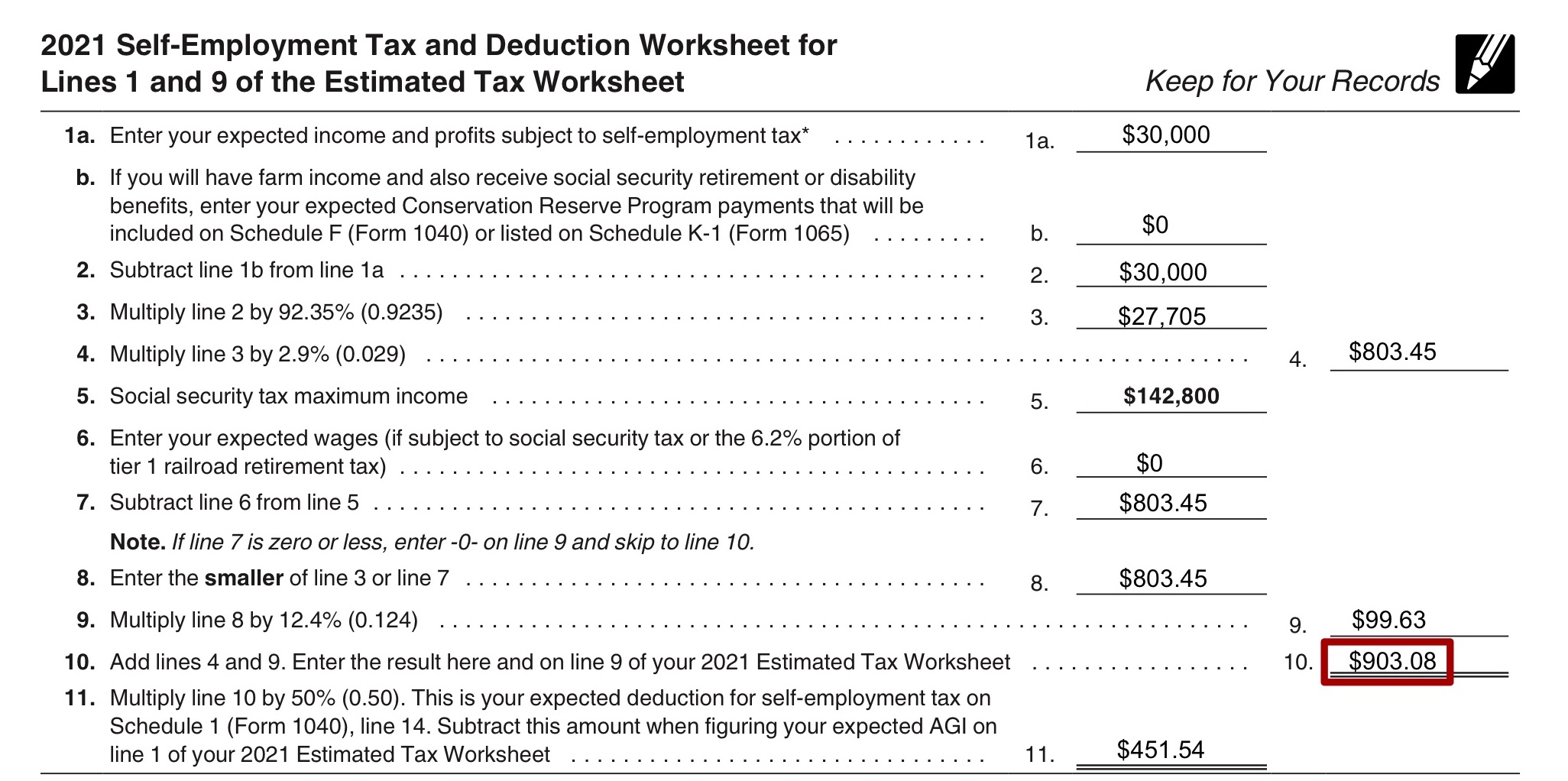

Estimated Tax Payments 2025 California Latest News Update, The purpose of that line of the worksheet is to determine whether all of your self employment income is subject to self employment tax. Calculate your income tax, social security.

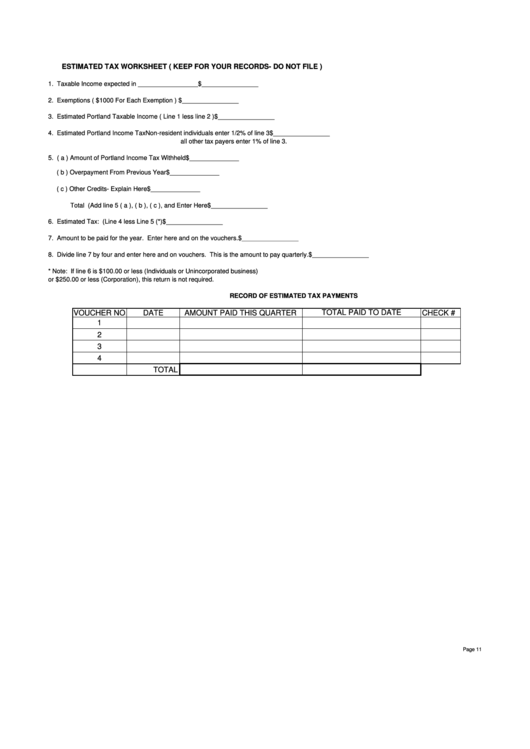

Estimated Tax Worksheet printable pdf download, Based on your projected tax withholding for the year, we can. Tax withholding and estimated tax (publication 505) explains.

Withholding Allowances, Default is to check this box if no entry in: Free online income tax calculator to estimate u.s federal tax refund or owed amount for both salary earners and independent contractors.